Bitcoin Critics Leaderboard

The top critics who have declared Bitcoin dead the most times. Click to see details.

312 critics tracked • Last updated: Mar 1, 2026

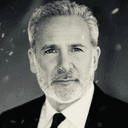

🥇

Peter Schiff

22

Deaths

🥈

Steve Hanke

10

Deaths

🥉

Warren Buffett

8

Deaths

#4

Nouriel Roubini

8

Deaths

#5

Jamie Dimon

7

Deaths

#6

Paul Krugman

6

Deaths

#7

Nicholas Weaver

6

Deaths

#8

Jacob King

5

Deaths

#9

Brett Arends

4

Deaths

#10

John Crudele

4

Deaths

And 302 more critics who got it wrong...

View All Obituaries →